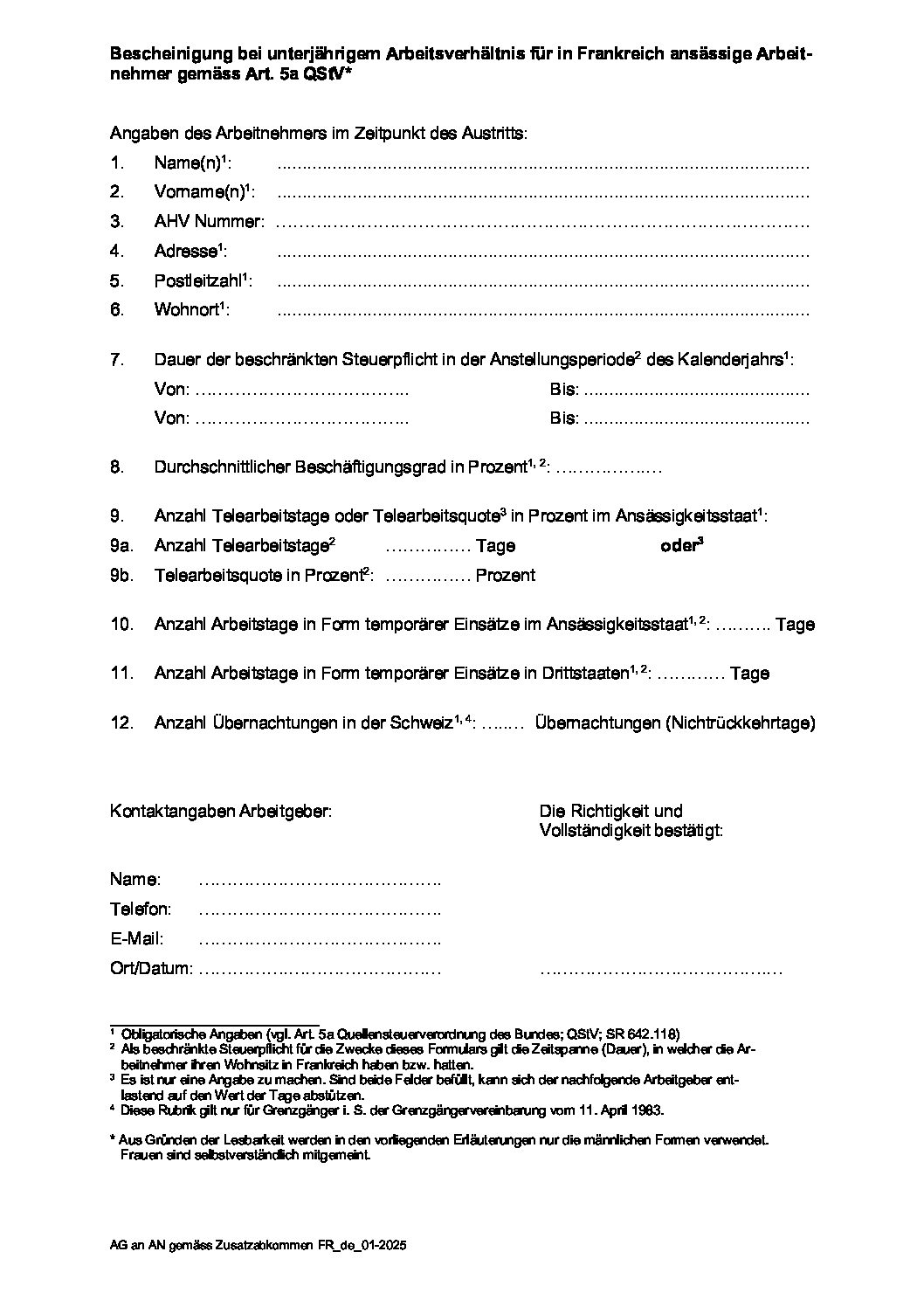

The Federal Tax Administration (FTA) published the employer certificate yesterday. This must be issued upon request from 1 January 2025 when employees residing in France leave the company.

The companies and institutions concerned (taxable persons liable for tax) are therefore equipped to issue such a certificate if required and requested by their employees when they leave.

Link to the webpage (available in German, French or Italian)

https://www.estv.admin.ch/estv/de/home/direkte-bundessteuer/dbst-quellensteuer.html

At the same time, detailed explanations of this certificate were published, which can be found on the same website.

Companies are well advised to read these in detail and to collect the necessary information on an ongoing basis. I also refer to the blog I created earlier:

https://www.zulaufgmbh.ch/en/news-in-the-context-of-reporting-for-employees-domiciled-in-france/

The next seminar on this topic in the area of taxation (France only) will be held in German on 15 May 2025 from 3:00 p.m. to 5:00 p.m.

I am also offering company-specific workshops on this topic, including social security, policies, etc.